Unless you live under a rock (like I do), you’ve probably heard the term “mortgage broker” get thrown around on more than one occasion.

You may have heard good things, and you may have heard bad things…

Opinions aside, a mortgage broker is an intermediary that works between the borrower and the bank to help the former obtain home loan financing.

Instead of contacting a retail bank or mortgage lender directly, you have the option of enlisting a broker instead, who will act as your liaison and loan guide.

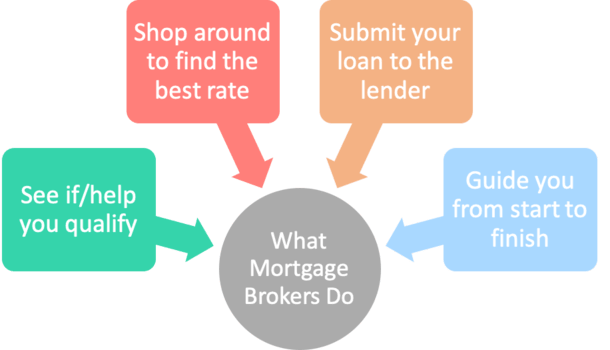

Brokers can help you apply for a mortgage and do most of the heavy lifting along the way, whether it be a home purchase loan or a mortgage refinance.

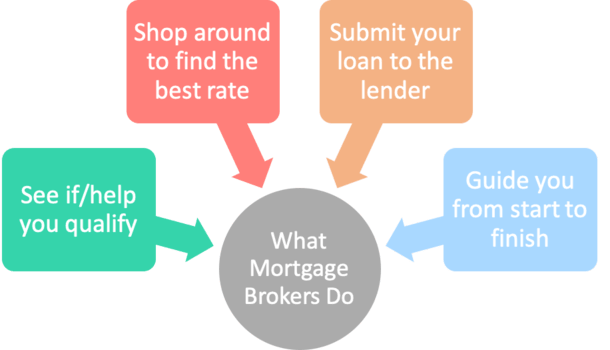

As you can see from my rather rudimentary, yet fairly time consuming diagram above, the mortgage broker acts as a liaison between two important entities during the home loan process.

The borrower/homeowner end is the consumer-facing retail side, while the bank/lender end is the wholesale (B2B) side.

These three entities don’t all communicate with one another. Instead, the mortgage broker communicates with both parties separately, so you’ll never actually speak to the bank or lender originating your home loan.

And you may not even know who the broker ultimately decided to place your mortgage with until you receive your loan servicing documentation after the loan funds.

Many of the large banks that offer retail mortgage services also have wholesale divisions, including Rocket Mortgage and Fairway Independent Mortgage.

And the nation’s largest mortgage lender is United Wholesale Mortgage (UWM), which works exclusively with mortgage brokers.

There are many similarities between broker and bank, along with a lot of key differences.

Similar to a retail loan officer, a mortgage broker will discuss loan pricing and eligibility with you early on. If you agree to move forward, they will gather important financial information.

This includes income (tax returns, pay stubs), asset (savings account, checking account statements) and employment documentation, along with a credit report.

All are necessary to assess your ability to obtain home loan financing. A retail bank would collect the same documentation, so no real difference there.

In the case of a mortgage refinance, they’ll assess current home equity, the property’s appraised value, and use a mortgage payment calculator to see what loan terms the borrower might benefit from, if any.

After the mortgage broker has all the important details, they can determine what will work best in the situation.

This may include setting an appropriate loan amount, loan-to-value, and determining which loan type would be ideal for the borrower.

Of course, the homeowner can decide on all these things on their own if they so choose. The broker is just there to help (and make their commission).

In fact, it might be in your best interest to do your research beforehand, then see how it stacks up once you speak with a professional to ensure you aren’t steered in the wrong direction.

As noted, mortgage brokers act as matchmakers. Their job is to pair you with a lender.

When all the details are ironed out, the broker will submit your loan to a wholesale lender partner they work with to gain approval.

The loan underwriting actually takes place with this third-party company, and the broker will let you know the outcome as soon as it’s completed.

You won’t be able to call up this lender directly if you have questions. Instead, you’ll deal directly with the broker and their team.

During the loan process, the broker will communicate with both the bank and you the borrower to ensure everything runs smoothly.

An individual known as an Account Executive (AE) works on the wholesale side and provides loan status updates to the broker.

Like a loan officer, mortgage brokers make money by charging a loan origination fee or via lender compensation.

In the paperwork you should be able to see how much they’re charging. Typically, it’ll range between 1-3% of the loan amount. Aim for lower when negotiating early on!

A mortgage broker will work on your behalf to find the best (lowest) mortgage rates available.

They can search through all their lender partner’s programs to find the right fit for you, and hopefully the most competitive pricing too.

For example, they may find that Bank A offers the lowest rate, Bank B offers the lowest closing costs, and Bank C has the best possible combination of rates and fees.

They will then submit your loan to Bank C on your behalf and begin the underwriting process.

This is the key advantage of a mortgage broker. They have the ability to compare mortgage rates with numerous banks and mortgage lenders simultaneously to find the lowest rate and/or the best loan program with the fewest costs.

If you use a traditional retail bank, the loan officer can only offer loan programs and corresponding mortgage rates from a single bank. Their own.

Clearly this would lessen your chances of seeing all that is out there. And who wants to apply for a mortgage more than once?

Keep in mind that the number of banks/lenders a mortgage broker has access to will vary, as brokers must be approved to work with each individually.

A broker who has been in the business a long time might have established a large number of wholesale partners to choose from.

In other words, one mortgage broker may have access to Rocket’s wholesale mortgage rates, while another may not. Generally, the more options the better. So ask the broker for multiple quotes from as many lenders as possible.

This is why it’s helpful to compare mortgage brokers too. Don’t jut stop at one, just like you wouldn’t get a single mortgage quote.

What they charge can vary greatly, so make sure you do your homework before agreeing to work with a mortgage broker. And ask what they charge before you apply!

Mortgage brokers work with borrowers throughout the entire loan process until the deal is closed.

Aside from gathering paperwork and providing quotes, they can run your loan scenario through different mortgage calculators to determine the best structure of the deal.

They may also recommend that you limit your loan amount to below the conforming limit so it adheres to the guidelines of Fannie Mae and Freddie Mac.

Or they may suggest that you break your loan into a first and second mortgage to avoid mortgage insurance and get a better blended rate.

If you have a particularly hard-to-close loan, they may have options that retail lenders may not, since most of the latter tend to stick to A-paper, vanilla stuff.

For example, if you have bad credit or are a real estate investor, brokers may have wholesale mortgage partners that specialize in mortgage loans just for you.

But your loan may not work on the retail level, so you’d never know about such programs without your broker liaison.

If you use a retail bank, they may just give you generic loan choices based on the loan application you fill out. And they may not provide any further insight in terms of structuring the deal to your advantage.

They may even miss a seemingly simple detail that could greatly impact the interest rate you receive, or even jeopardize your loan approval.

So if you’ve already been turned down by a bank, a mortgage broker might be able to save your deal and get you the financing you need. In a sense, they can be compared to financial advisors for the mortgage realm.

Overall, they’re probably also a lot more available than loan officers at retail banks since they work with fewer borrowers on a more personal level. This means they could be a good choice for first-time home buyers, who may need more of a helping hand.

This is another big advantage over a retail bank. If you go with one of the big banks, you may spend most of your time on hold waiting to get in touch with a representative.

Additionally, if your loan is declined, that’s often the end of the line. With a mortgage broker, they’d simply apply at another bank, or make necessary changes to turn your denial into an approval. They generally have access to a lot more loan products.

Mortgage brokers can originate all types of loans, from conventional loans to FHA loans and everything in between.

Their offerings will depend on the wholesale lending partners they are approved to work with.

Some may specialize (and be experts) in certain types of home loans, such as USDA loans or VA loans.

So if you know you’re looking for a specific type of loan, seeking out one of these specialized brokers could lead to a better outcome.

They may also have partners that originate jumbo mortgages, assuming your loan amount exceeds the conforming loan limit.

And they can get you a second mortgage if you decide to structure the financing as a combo loan.

Like retail lenders, they can also offer no cost loans by utilizing a lender credit, which will effectively raise the your interest rate, but eliminate out-of-pocket costs.

Borrowers can choose if they want to pay these costs at closing or via a higher interest rate. Ask your broker to clearly discuss both options before proceeding.

Mortgage brokers were largely blamed for the mortgage crisis because they originated loans on behalf of numerous banks and weren’t paid based on loan performance.

And most of the loans were quickly resold to investors on Wall Street, as opposed to staying on the bank’s books.

Studies have shown that these originate-to-distribute loans have performed worse than loans funded via traditional channels.

But the big banks were the ones that created the loan programs and made them available, so ultimately the blame lies with them.

If the programs didn’t exist to begin with, brokers wouldn’t have been able to offer those types of loans. Also, brokers weren’t the ones doing the underwriting.

Post-crisis, many big banks including the likes of Bank of America exited the wholesale business to focus on customer-driven strategies, like cross-selling products in-branch.

After all, if they work with the customers directly, they have additional opportunities to sell products like savings accounts, credit cards, and so on.

They can also underwrite and manage all their mortgage loans in-house to ensure nothing slips through the cracks.

Regardless, there’s no sense getting caught up in the blame game. It is recommended that you contact both retail banks and mortgage brokers to ensure you adequately shop your mortgage.

Most borrowers only obtain a single mortgage quote, which certainly isn’t doing your due diligence.

Are mortgage brokers free?

Like all other loan originators, brokers charge fees for their services, and their fees may vary widely. It costs money to run a mortgage brokerage, though they may run leaner than a big bank, passing the savings onto you.

In terms of commission, they may get compensated from the lenders they connect you with, or ask that you pay broker fees out of your own pocket at closing.

If they aren’t charging you anything directly, they’re simpy getting paid a broker commission by the lender. This means you’ll wind up with a higher interest rate to compensate.

Be sure to explore lender-paid and borrower-paid options to get the best combination of rate and fees.

Do mortgage brokers cost more?

Not necessarily; as mentioned mortgage brokers can offer competitive rates that meet or beat those of retail banks, so they should be considered alongside banks when searching for financing.

They have the ability to shop numerous lenders at once so they can find the best pricing based on your needs.

But it really depends who you use and whether another entity can do better for your specific loan scenario.

For example, a broker may have access to excellent refinance rates thanks to a pricing special with a given wholesale lending partner.

Do mortgage brokers need to be licensed?

While licensing requirements do vary by states, mortgage brokers must be licensed and complete a criminal background check including fingerprinting.

Credit checks and minimum experience are also often required. Additionally, brokers must usually complete pre-license education and some must take out a bond or meet certain net worth requirements.

Are mortgage brokers regulated?

Yes, mortgage brokers are regulated on both the federal and state level, and must comply with a large number of rules to conduct business.

Additionally, consumers are able to look up broker records via the NMLS to ensure they are authorized to conduct business in their state, and to see if any actions have been taken against them in the past.

What types of loans do mortgage brokers offer?

Depending on who they’re approved to work with, anything and everything from Fannie Mae and Freddie Mac to FHA loans and jumbo loans, second mortgages, non-QM loans, streamline refinances, and various other loan types that may only be offered via the wholesale channel.

Do mortgage brokers service loans?

Typically not. Mortgage brokers work with the banks and lenders that eventually fund your loan.

These banks will either keep the loan on their books or sell it off to another company, who in turn may service the loan. You likely won’t know what bank owns/services it until after it funds.

But this can happen with retail banks as well since there’s a good chance your loan servicer may change once or twice after your loan closes.

Do mortgage brokers make money on refinancing?

Yes. Since they don’t hold the loans they originate, any new loan, whether it’s a purchase loan or a refinance loan that they previously funded, will earn them a commission.

And like a purchase loan, they’ll typically earn 1-3% of the loan amount as compensation, either paid by the borrower or the lender.

The one caveat is they might not be able to refinance your loan for six months to avoid commission recapture. So if you’re told you have to wait, you can oblige to help them out or shop your loan elsewhere.

Are mortgage brokers going out of business?

While mortgage brokers account for a much smaller share of total loan volume these days, they still hold a fairly substantial slice of the pie. And it has been rising again lately.

Despite the ups and downs that come with real estate, they will most likely continue to play an active role in the mortgage market because they provide a unique service that large banks and credit unions can’t imitate.

So while their numbers may fluctuate from time to time, their services should always be available in one way or another.

Where do I find a mortgage broker?

There are a variety of different ways to find one. You might be recommended one by your real estate agent or by a friend or family member. Everyone seems to know one.

Or you can seek out a mortgage broker in your area by reading online reviews. It might be smart to work with someone local who you can sit down and meet with as opposed to one not in your immediate area.

And always ask for references!

Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 18 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on Twitter for hot takes.

Latest posts by Colin Robertson (see all)I saw a home I liked far away in another state. I could very easily afford 20% down and also very easily afford the mortgage payments. My problem is that my FICO is probably too low for a conventional loan. I don’t want to be an investor. I just want to live in the house. I can not move

to where the house is for two years and I assume it will be off the market by then. If I could get the home today, I would be just fine leaving it empty till I could move to that area. I’m pretty sure I could get an FHA loan except for the owner occupancy rule. I would never break the law, but

I wonder if the FHA would understand my situation. If not, is there any other path for me outside of raising my FICO to 620? I plan to do this, but I’m afraid the house would be

sold by then. I really like this house.

Hi Jim, Depends why your score is below 620…if it’s an easy fix you might be able to get it back to where it needs to be in a hurry, but if it’s not…some brokers are quite knowledgeable and can guide borrowers in the credit department. Good luck.

Thanks 4 your info. I live in florida and here u need a TITLE CO. to buy a house. What is a title co.?

Also, how does the FDIC insure my mortgage loan; I have heard that if I have a foreclosure for my conventional loan with PMI, the FDIC must pay the lender/bank what I owe and I could be liable to pay the government back; is this true?

Any advice will be greatly appreciated.

sincerely. tom Jones

Tom, The PMI company pays the lender if you default and there is mortgage insurance in force. Title insurance protects you and the lender from issues involving ownership of the property.

Hi I was just wondering I went to a bank to see if I could get a loan for a house and they denied me because of my credit history and I was just wondering is there any way I could get a loan or what is it that I have to do

Colin Robertson July 7, 2015 at 9:35 amNelson, One bank may say no but another may say yes. Do some reading on my site and you’ll have a better understanding of why you may or may not get approved for a mortgage. You may also want to look into why your credit isn’t so hot. Good luck!

Hi, I have credit score of 693 and adequate income.

However, I had a house that I thought the bank took back in an old bankruptcy, I recently found out that they did not take back the property so the city has been charging me for the property tax. I just received a letter telling me that the house has been sold in an auction. I am trying to get a mortgage on another home but the underwriter says that since that property tax is a debt I owe I can not get a loan until three years, is there anyone who can assist with this type if scenario.

Think of it drawing this analogy. Mortgage broker = used car sales person

Underwriter = dealer finance guy Dont trust either one.

Hello. We are currently building a house. We have a signed contract, and we worked with a mortgage broker to give us a pre-qualification. However, before we have the pre-qualification, we never shopped for mortgage brokers. I would like to start shopping now, as we have over 2 months before the house will be done. Can I still change lenders/mortgage brokers or I am already set to work with the one who gave us the pre-qualification? I feel that right now, they are just throwing me a number thinking that we are desperate to purchase our new home.

Colin Robertson November 9, 2015 at 4:58 pmKatrina, You don’t need to use the bank/broker who gave you the original pre-qual…it’s generally good to shop around to see what’s out there and to compare rates/fees etc.